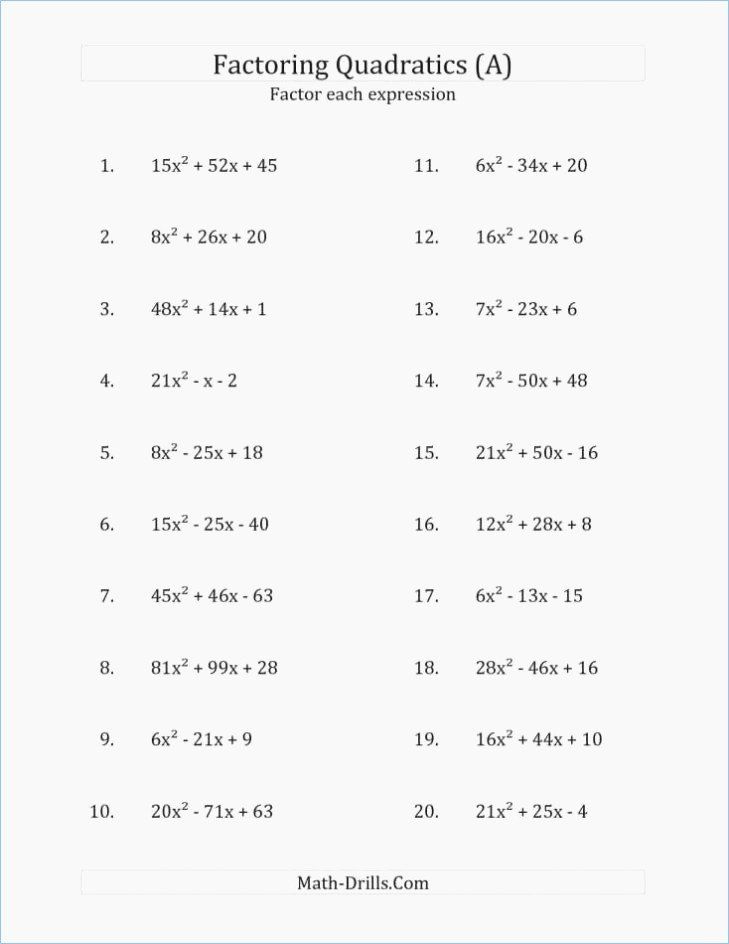

In this lesson you will go through 15 different exercises related to polynomial. This set of problems only incorporates positive numbers so that your students can focus on their factoring skills.

Solving Polynomial Equations Worksheet Answers Best Of Solving Polynomial Equations By Factoring Worksheet T In 2020 Algebra Worksheets Factoring Quadratics Quadratics

These worksheets focus on the topics typically covered in algebra i.

Factoring polynomials worksheet. The product of any number and a whole number d. Multiplying monomials worksheet multiplying and dividing monomials sheet adding and subtracting polynomials worksheet multiplying monomials with polynomials worksheet multiplying binomials worksheet multiplying polynomials simplifying polynomials like terms factoring trinomials. Once you find your worksheet click on pop out icon or print icon to.

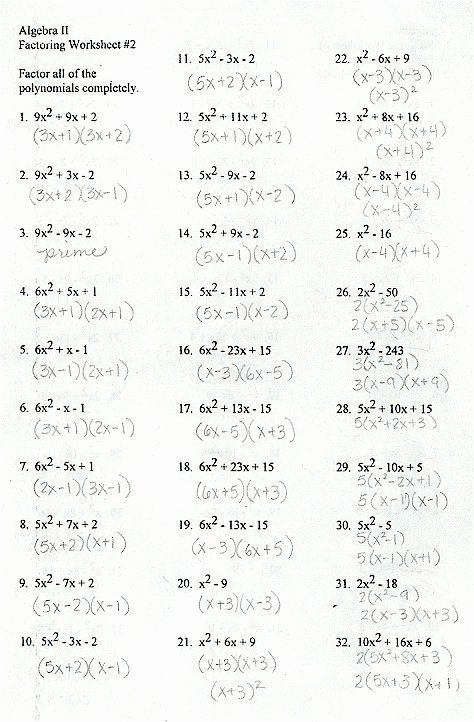

Factoring polynomials addition worksheet here is a ten problem worksheet that will help your students refine their ability to manipulate and factor polynomials. 28 factoring polynomials practice worksheet with answers rather than inserting the exact same text modifying font styles or correcting margins every time you begin a new document opening a personalized template will let you get directly to work on the content instead of wasting time tweaking the styles. Algebra worksheet section 10 5 factoring polynomials of the form bx c with gcfs factor pletely name block 1201 8 5a2 4 a a 4y3 10 12 16 18 20 11 13 4 10 20 3 y 2 18 x 4 15 3 56 2 9p2 72 3 4 21 3 lox b 3b3 9a2 4y2 10 3 24 10b2 75 2 o 0 solve each equation by factoring 15 19 3 2 2y2.

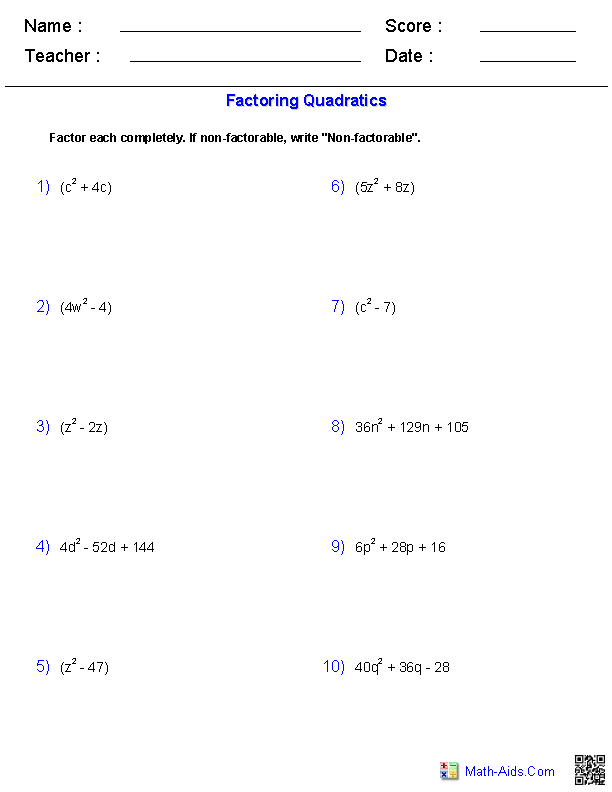

A b and b a these may become the same by factoring 1 from one of them. Factoring polynomials 1 first determine if a common monomial factor greatest common factor exists. Included here are factoring worksheets to factorize linear expressions quadratic expressions monomials binomials and polynomials using a variety of methods like grouping synthetic division and box method.

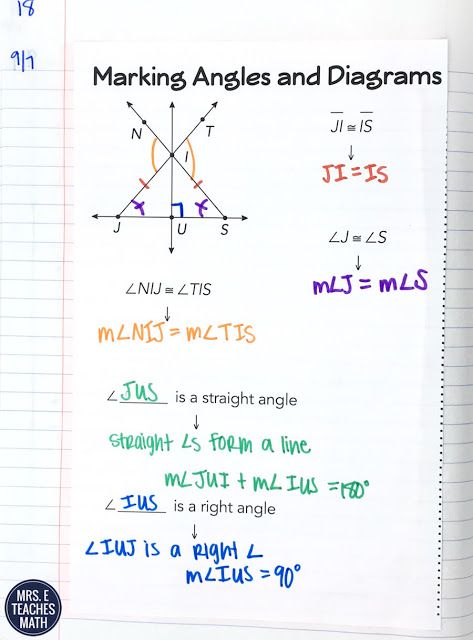

Page 3 lesson 1. A whole number greater than 1 that has more than two positive factors b. Factoring trinomials of the form 2 where 1 pg.

A polynomial with two terms c. Factoring is a process of splitting the algebraic expressions into factors that can be multiplied. You will also find all the answers and solutions.

Vocabulary match each term on the left with a definition on the right. Some of the worksheets displayed are factoring trinomials a 1 date period factoring polynomials gcf and quadratic expressions factoring polynomials factoring practice factoring quadratic expressions factoring polynomials 1 algebra 1 factoring polynomials name. A whole number greater than 1 that.

Factor trees may be used to find the gcf of difficult numbers. Factoring using the greatest common factor factor each expression by factoring out the gcf. A number that is written as the product of its prime factors e.

Resources academic maths algebra polynomials factoring polynomials worksheet. 15 review more practice factoring with pizzazz worksheets pg. Be aware of opposites.

Education Factoring Polynomials Gcf Worksheet Factoring Polynomials Algebra Worksheets Multi Step Equations Worksheets

Factoring Trinomials Worksheet Answers Awesome 10 Best Of Factoring Polynomials Practice Worksheet Chessm In 2020 Factoring Polynomials Factor Trinomials Polynomials

This Factoring Trinomials Maze Was The Perfect Worksheet To Help With Factoring Trinomials And Factoring Polynomials Factoring Polynomials Activity Polynomials

Factoring Polynomials Matching Polynomials Factoring Polynomials Algebra Interactive Notebooks

Factoring Polynomials Gcf Factoring Polynomials Algebra Polynomials

Pin By Jamie Riggs Missmathdork On Teachers Pay Teachers Missmathdork Algebra Worksheets Factor Trinomials Learning Mathematics

Factoring Trinomials Worksheet Answers Luxury Factoring General Trinomials In 2020 Factoring Polynomials Factor Trinomials Mathematics Worksheets

Multiplying And Factoring Polynomials Card Sort Factoring Polynomials Teaching Algebra Teaching Math

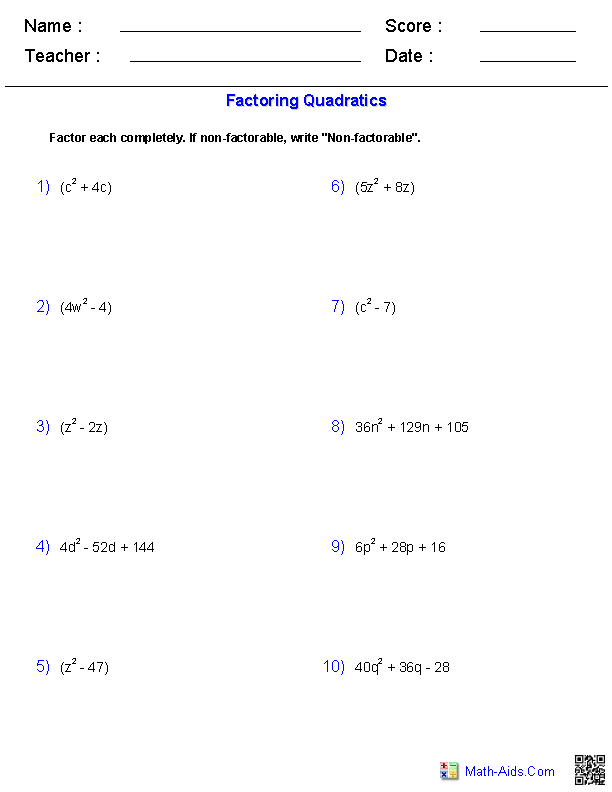

Factoring Quadratics Worksheet Quadratics Factoring Quadratics Worksheets

This Worksheet Includes 15 Practice With Factoring Trinomials As Well As Special Cases Such As Difference Factoring Polynomials Polynomials Writing Equations

Gcf Of Three Monomials Gcf Greatest Common Factors Factoring Polynomials

Factoring Trinomials When A 1 Worksheet Factor Trinomials Math Practices Common Factors

Factoring Over Real Numbers Precalculus Real Numbers Polynomials

Factoring Trinomials Puzzle Activity Freebie Factoring Quadratics Activities Factoring Quadratics Factoring Trinomials Activity

Search And Shade Worksheets Hoppe Ninja Math Teacher Blog High School Algebra School Algebra Algebra Worksheets

More Factoring Over Real Numbers Polynomials Worksheets Factoring Polynomials

Factoring Polynomials Worksheet Answers Fresh Factoring Trinomials Worksheet Easy By Elizabeth Gra In 2020 Factoring Polynomials Polynomials Character Trait Worksheets

Algebra 1 Worksheets Monomials And Polynomials Worksheets Quadratics Polynomials Polynomial Functions